I’m not advocating tax fraud, and I’m not a lawyer. I’m just saying—whether you’ve put your stimmy checks in Bitcoin and become a millionaire, or are simply feeling the gravity of 1099 forms at tax time, or find NFTs baffling or exhausting—plain old-fashioned money-laundering is still a thing. That artworks have long been vehicles for hiding wealth is one reason that so many artists, in turn, have taken an interest in the high-stakes schemes attached to art. But there are metaphysical appeals, too. Arcane financial maneuvers, only nominally attached to physical objects, regularly achieve a level of dematerialized abstraction to which most conceptual art only aspires: the transubstantiation of nothing into something.

There are countless variations on the theme, but rinsing dirty funds always requires cycling gains back to their owner through an untraceable chain of transactions. This is the premise of Maura Brewer’s recent show “Integration” at Canary, a project space in LA’s fashion district (an area of cash-heavy and wholesale businesses, more than a few of which have been accused of laundering dollars for drug cartels).1 From late January to early March, Brewer methodically covered her financial tracks—setting up a dummy Limited Liability Company or LLC, routing money through it, withdrawing cash, and using it to buy an artwork by Buck Ellison consigned through Canary—and presented the process in a series of short videos, which accumulated on monitors in the gallery’s back room. (It’s a permanent quirk of the space that its front gallery and back “office” are surveilled by two webcams, accessible on their website at all times.)2

The footage is less than incriminating, more like obscure illustration. There are many shots of driving: the artist in her car in the desert or on the phone, laying plans. Another, final video shows her opening an envelope and unfurling the certificate for her LLC, then laying out several thousand dollars in mixed notes, one by one, so that their serial numbers show. Nothing demonstrated is illegal in itself. It’s a bit like the reenactment of a Robert Barry work included in Brewer’s first video, playing on a TV on a desk: an open tank of helium, a camera recording the gas mixing with the air—watching something invisible. Brewer notes that Barry’s Inert Gas Series from 1969, and the advent of conceptual art in general, coincided with the US unpegging the dollar from gold in 1971. Ever since, our currency has been allowed to float.

So what is this, then—a research-practice version of Cagean silence? An otherwise cagey comment on art’s financialization? The point is that art’s worth is never far from the practical magic of imparting value on thin air. Brewer’s project has the aura of a “financial thriller”—in a way that recalls an elaborate project by artist duo Goldin+Senneby titled Headless (2007–15), ostensibly sparked by their learning about a shell company called Headless, Ltd.3 To two well-read artists, the name suggested the psychosexual thrill of Acéphale, or “headless,” a secret anti-fascist society and/or suicide cult founded by Georges Bataille. G+S, who according to their website explore “the structural correspondence between conceptual art and finance capital,” a reifying practice, hype up the “acéphalesque” of contemporary finance by piling on as many authors as possible.

The moniker G+S itself is an incorporation of two artists “not present” in this work. Instead, Headless enlists a series of actors, financiers, a ghost writer, and other experts to play a shell game of worldwide tax evasion and money laundering, as well as people to appear on the artists’ behalf at dinners and panels, up to and including the double umbrella of their publishers, Triple Canopy and Sternberg Press. The project culminated in an experimental detective novel that tells the story of its own making by a cadre of proxies and freelancers, none of whom could see the whole plot.4 This cascade of false fronts and postmodern author-murders overcompensates for the central void of Headless, Ltd., an entity with no “author”—no head—of its own. Again, scot-freedom is not innocence. The mechanisms are in plain sight; each step is more or less legal under the wavering jurisdictions through which they are administered. Somewhere in the chain of transactions is a blank box, a missing signature, an anonymous LLC: a headless man…

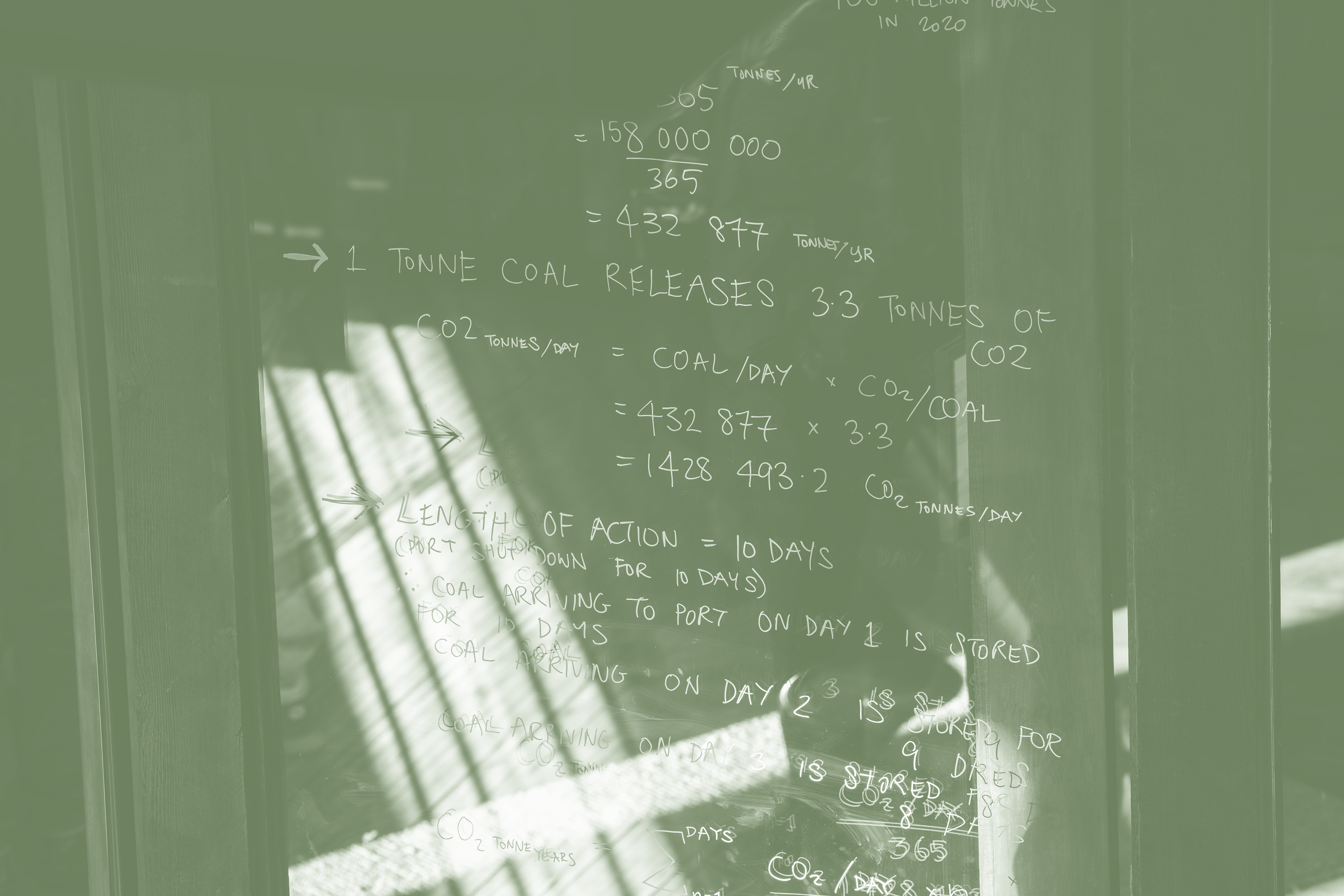

G+S focus on “offshore,” namechecking its notorious havens: Switzerland, Gibraltar, the Caribbean. Brewer’s work, though, is emphatically “onshore.” Her paper LLC resides in Wyoming, where there are no state taxes and so little regulation that the richest county in the US isn’t on either coast—it’s Teton County, WY, the so-called billionaire wilderness.5 No surprise that Jackson Hole’s largest sector, second to environmental tourism, is art. At Canary, there’s an audio piece in which a handful of actors read from interviews with art-world insiders, from an art handler to a lawyer, who describe shows selling out before they open and assets slipping across oceans via galleries with international footprints. What the art looks like or “speaks to” is only gravy. Naturally, many artists are enthralled with finance. This adjacency can facilitate an easy slide from heartfelt expression to cynical financial instrument. It seems to undercut the idea of art as a force for good—one that justifies both art institutions and the philanthropy that floats them.

The upshot is that art is an excellent washing machine. Regulations are lax. Secrecy is also grandfathered into the art market from the days when gentry wished to spare the reputations of those forced to auction. A 2017 New York Times piece on the subject notes that auction houses still rely on commissions, and so may not always look so deeply into the origins of what they’re selling or the cash that buys it.6 Add to that the feeling of luxury that comes with ease and privacy and exclusivity, a culture of back rooms and VIP previews. Not that there’s anything wrong with this per se—any more than bars, wholesalers, and other common fronts are wrong. But artists and curators are demanding openness about the names listed on museum walls, from Zabludowicz to Sackler, in effect uncloaking the sources of the wealth that underwrites culture through a time-honored form of “reputation laundering.”

Above all, the uniquely subjective nature of art’s aesthetic value means that the profane, irrational valuations of the art market go unquestioned—to the point where Dave Hickey could argue that the market literally measures beauty. NFTs? Sure. But the Duchamp of In Advance of the Broken Arm (1915)7 has them beat by a century. As part of “Integration,” Brewer used the gallery as a studio to photograph other objects that have been used as currency in the past, including a live cow. The ultimate “container” for the value laundered at Canary is Buck Ellison’s framed print of a properly licensed stock photo of white, clapping, shirt-cuffed hands in shallow focus. Brewer’s project risks provoking both white-collar benefactors and the IRS. But the sums she and Canary are handling aren’t likely to be worth the feds’ time, and her graying of the law is mostly an aesthetic choice. Instead, it’s art’s ambivalent approach to settle for the fact that money is a metaphor, and art is too—that both share the privileged space where concepts become real power.

https://www.latimes.com/local/lanow/la-me-ln-neman-brothers-sentening-20181218-story.html; https://ktla.com/news/local-news/feds-raid-l-a-s-fashion-district-in-drug-money-laundering-probe-2/.; https://ktla.com/news/local-news/owner-of-l-a-fashion-district-company-and-son-indicted-in-money-laundering-scheme/.; https://www.reuters.com/article/us-usa-fashion-raids/los-angeles-fashion-district-raided-in-drug-money-laundering-probe-idUSKBN0H52GZ20140910.

See Travis Diehl, “Plotting a Post-Crash Potboiler: Headless by G+S,” X-TRA, Fall 2015, https://www.x-traonline.org/article/plotting-a-post-crash-potboiler-headless-by-gs/.

See Justin Farrell, “Where the Very Rich Fly to Hide,” New York Times, April 15, 2020, https://www.nytimes.com/2020/04/15/opinion/jackson-hole-coronavirus.html.

See Graham Bowley and William K. Rashbaum, “Has the Art Market Become an Unwitting Partner in Crime?,” New York Times, February 19, 2017, https://www.nytimes.com/2017/02/19/arts/design/has-the-art-market-become-an-unwitting-partner-in-crime.html.

See Angie Keefer, “Futures,” Bulletins of The Serving Library #7 (2013), http://www.servinglibrary.org/journal/7/futures.