Michael Bloomberg, once referred to as “America’s greenest mayor,” launched One Million Trees for New York (MTNYC) in 2007.1 This project, initiated as the subprime mortgage crisis started to be noticed, ventured to protect citizens from the effects of air pollution and climate change. Working to add the eponymous number of trees to the city, MTNYC was considered the largest urban afforestation effort in the world. Highlighting the benefits of improved air quality, increased shading, and reduced energy consumption, the majority of trees were planted in low income neighborhoods with poor tree canopy and high asthma rates. The aspiration was to increase the city’s “urban resilience” in times of devaluation of real estate assets and ecological collapse. The project was accompanied by an extensive community-based survey that invited people to document trees in their neighborhood. This promoted the caretaking and mapping of the different species by involving “the community” in that process. Volunteers contributed 12,000 hours of their own time, worth an estimated $100,000, inventorying the city’s trees.2 As a consequence, every single tree in the city was assigned an economic value based on the “environmental services” it performed.

It is difficult to argue against afforestation, but why is the accurate value of every single tree so relevant to the city? Who is benefitting from it? Is this a second wave of what David Gissen refers to as “environmental gentrification” initiated in NYC during the 1970s?3 Before current quantifications that assign figures and formulae to plants, their value was extracted in a more direct way. When British Empire forestry was first established as a disciplinary practice in India, formalizing the right of the state over “nature,” it proscribed private interests and initiated a new system of forest management based on a logic of utilitarian preservation.4 Rather than the actual survival of plants or animals, the goal of this forestry was focused on preventing the exhaustion of resource extraction. Using the universal goodness of plants to prevent indigenous peoples from living off the forest for the sake of the “environment,” Empire forestry eventually masqueraded a form of biopolitical control, limiting access to the forest for its original dwellers. Furthermore, the extraction of commodities from every single tree (timber, rubber, or pharmaceutical substances) has been used as a form of ecocracy throughout history: controlling space and people through the conservation of ecology. This conservation paradigm implied that the ruling class could keep extracting material resources from trees without exhausting the forest. As Arun Agrawal articulates with his notion of environmentality, much before the pacifist Chipko movement of the 1970s, the reclassification of forests into designated reserves led villagers in Northern India to resist becoming environmental subjects through violent actions. They started hundreds of forest fires in the early 1920s to protest colonial British regulations that were passed to “protect the environment” from the harms the Empire itself inflicted.5

A century later, the failed attempts to develop mechanisms for long lasting and sustainable material extraction have brought forth financial quantification as a new theory and practice of conservation. The extraction of value from trees does not imply subtraction of physical matter (sap, bark, leaves, roots, or oil extracts), but rather precisely by keeping all that materiality intact and in place. Trees have turned into carbon reserves that are to be protected from any form of indigenous, domestic, or industrial usage, so that they keep acting as fixed carbon sinks. Contemporary struggles in Niassa, Mozambique against the neocolonial logic of “afforestation projects” reflect similar uprisings in early twentieth century India, where forests are being “preserved” to offset air pollution in cities of the global North. In protest of consequent land dispossessions, thousands of pine trees planted by multinational “Green Resources” corporation were uprooted in 2013.6

The New York Street Tree Map (NYSTM), released online in early 2017 by the Department of Parks and Recreation, is deeply embedded in the financial quantification of trees and reveals a slightly less benevolent agenda behind urban greening. Despite the publicly stated goal being the maintenance and caretaking of the trees in the city, the target of NYC Street Tree Map is to “provide tools for developers.”7 The 681,053 street trees that appear on the cartographic tool provide much more information than the species, trunk diameter, and exact address of each plant. Utilizing the Tree Carbon Calculator (TCC), a federally approved spreadsheet developed by the Center for Urban Forest Research, the yearly capacity of stormwater interception, energy conservation, air pollutant removal, and CO2 reduction prefigures each tree on the database.8 Plugging this latter set of information into an algorithm behind environmental investment software allows the TCC to accurately calculate the annual financial benefits provided by each one of those trees, which developers or industrialists who have to mitigate their environmental damage can pay to “neutralize” the detrimental effect of their activities.9

The way this mechanism works can be explained by looking at one of the most iconic corporate atria of New York, Kevin Roche John Dinkeloo and Associates’ Ford Foundation Garden (1967). Produced in response to fears of the City’s endemic pollution, its protected environment was built to display how corporations also cared about cultivating “urban nature.”10 It “wasted” floor area inside the building to gain green reputation. Today, however, the Ford Foundation atrium is losing greenwashing capacity to the six thornless honey locusts right outside, on 309 East 42nd street, and another six in front of the façade on 320 East 43rd street. They measure between three and eleven inches in diameter. One of them in particular intercepts ten dollars and twelve cents worth of stormwater, conserves one hundred and fifteen dollars and fifty-one cents worth of energy, removes eight dollars and twenty-one cents worth of air pollutants, sequesters one dollar and thirty-eight cents worth of CO2, providing a total of $136.59 in annual benefits.

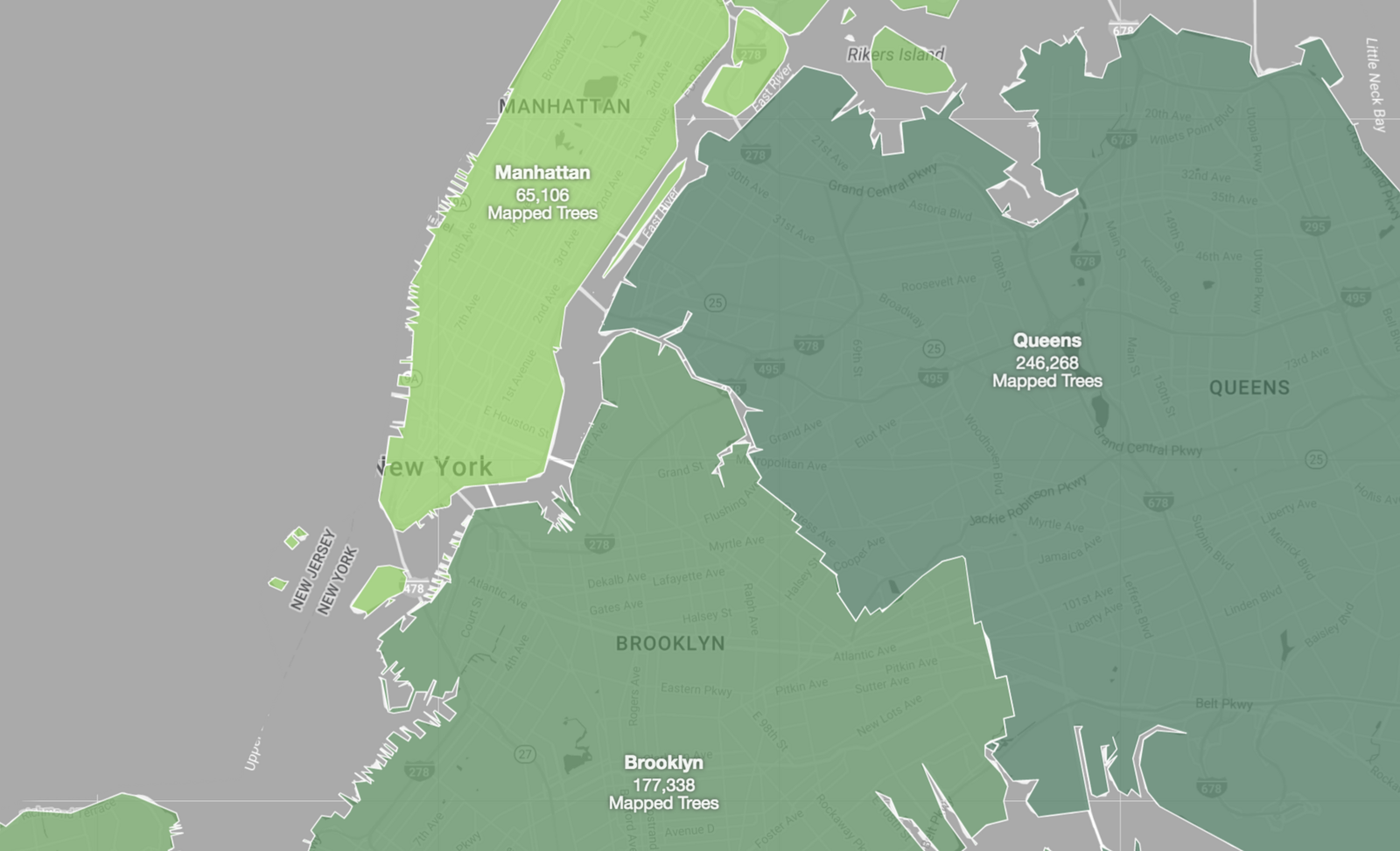

When amounted together, Brooklyn counts on a total of 177,873 trees, which are worth for the local authority almost thirty million dollars. Queens has 247,165 trees, which are worth forty-four million, five hundred fifty-four thousand, and nine hundred and eighty-two dollars and seventy-four cents per year in environmental benefits. Throughout the five boroughs of NYC, all mapped trees are annually providing one hundred and ten million, six hundred and seventy-three thousand, seven hundred and eighty-eight dollars and twenty cents. Now marked with a fully articulated and mathematically sound price tag, trees can automatically become objects of transaction and start to offset environmental damage from any development elsewhere. Planting trees is thus the outcome of an emerging and carefully engineered government of financial flows: the cartography of street trees constitutes a dataset for the calculation of “environmental services” (the services that nature suddenly provides to humans). By means of the software, these services can be turned into “financial gains” that the city can start accumulating by benefiting from environmental destruction.

NYC trees are branded as an “urban forest.” But more than just greening the city, they are an “offset forest”: its trees have acquired the mission to trade environmental destruction with environmental preservation. At the same time, their newly assigned role expropriates all kinds of inhabitants of the city from their environment, as the main aim of the trees is to become a public asset for developers. The degree of authority of those paying for the environmental services of each tree is uncertain, despite the trees being rooted in public soil. In this case, what is conserved is not just trees to improve air quality in the city, but also its real estate capital flows. Humans and other-than-humans thus become financial victims of conservation.11 Trees that provide environmental services for offsetting purposes could, as has happened in places like India or Mozambique, be prioritized over aesthetic, health, or ecological concerns.

This circulation of greening capital to mitigate architectural development is indebted to George H.W. Bush’s No Net Loss policy, passed in the 1980s. According to No Net Loss, any development that destroys natural habitats (especially wetlands, streams or vernal pools) has to be recouped by the restoration of an “equivalent” landscape elsewhere. The net amount of biodiversity is meant to remain “the same” in terms of surface, quality, or quantity. For each acre of lost wetland, for instance, there should be at least one acre created or restored. This one-for-one logic becomes perverse when the idea of preservation gets thrown into the mix: a developer can destroy a forest for the construction of a condominium on site A and pay a third-party entity owning an equivalent amount of trees on site B to preserve them. Like the trading of air-rights to build higher developments, this logic of urban afforestation has evolved into more sophisticated forms. Air pollution can be legitimized as long as it is traded with planting and keeping trees untouched that absorb the equivalent amount of CO2. The US government has recently updated its social cost of carbon to $37 a ton, which refers to the total social and environmental benefits that accrue from avoiding the emission of one ton of CO2, or alternatively, the damage done by releasing that ton of CO2.12 Once these equivalences are set, trading can easily commence.

With this logic of offsetting by means of environmental mitigation, architecture acquired the agency to destroy, displace, and replicate natural landscapes miles away from their original location. Offsetting becomes a financial practice that swaps destruction there with reconstruction, or preservation here. Eventually, spatial offsets are directly entangled with the offsetting, and obfuscation of responsibility. As María Gutiérrez remarks, even if such a mechanism of spatial offsetting was to be considered environmentally sensitive, it is not clear yet who is accountable if, for instance, the mitigation forest catches fire or succumbs to a disease, releasing all the “stored carbon” back into the atmosphere.13 Hence, environmental mitigation and holding trees accountable as a solution remains nebulous.

In the same decade that No Net Loss emerged as a form of circulating financial value through the environment based on entirely unscientific calculations of return, concepts of “biodiversity” and “sustainable development” also appeared in the literature and practice of financial ecology. In the 1980s biologists shifted from providing facts about the natural world (already social constructions themselves) to start speaking of nature’s “values.”14 As facts were not enough, subjective valuation of nature started playing a more ambiguous active role, malleable enough to different economic interests. There are many ways of valuing, but unlike the concept of wilderness, the moment “natural variety” appeared (the fact that species are different and contribute differently to the ecological balance of a habitat), the gradients of environmental importance to biodiversity easily became a commodity that could be compared, exchanged, lost, gained, depleted, restored, quantified, and scientized; allowing metaphors such as “balance of nature” to disguise poor understandings of ecology.15

Environmentality and the entangled forms of contemporary power struggles between polluting and cleansing sites in the Global North and South only got worse with the first carbon offsetting schemes formalized with the 1997 Kyoto Protocol. Air pollution in the Global North was accepted as a lesser evil of modernization if compensated with “sustainable” afforestation programs in the Global South that “enhanced global biodiversity.” Offset forest projects turned environmental guilt into a tradable commodity. Rich nations became entitled to keep polluting as long as they ensure that impoverished nations keep their forests intact, or their land grabbed to green the planet. Some of the ethical contradictions in this postcolonial logic were obviously reinstating abusive power dynamics within a pseudo-environmentalist discourse, as in one of the first post-Kyoto offsetting projects, where US-based Applied Energy Services promised to plant millions of trees on the highland hills of Western Guatemala in exchange for permission to construct a large, coal-burning power station in Connecticut.16 This “participatory” planting project, branded as Mi Bosque, was calculated to absorb as much CO2 from the environment as would be produced by the power station over its lifetime. It was meant to sequester between 15.5 and 16.3 million tons of carbon over 40 years, but according to a report, only 270,000 tons of carbon were offset by the project over the first ten years.17 Therefore, the ways in which any carbon footprint is neutralized through corporate social responsibility only exacerbates the still-colonial relationships between the rich and the poor, between high carbon-emitting nations’ right to pollute and enjoy and low carbon-emitting nations obligation to cleanse and labor.18

Mapped trees in the neighborhood of East New York, Brooklyn, as of August 25th 2017 on the NYC Street Tree Map.

Mapped trees in Harlem as of August 25th 2017 on the NYC Street Tree Map.

Mapped trees in Manhattan as of August 25th 2017 on the NYC Street Tree Map.

Mapped trees in the neighborhood of East New York, Brooklyn, as of August 25th 2017 on the NYC Street Tree Map.

From No Net Loss to profiting from bioassets and local livelihood, what is emerging appears to be a new green space race. Nations and companies are competing to appropriate the last piece of available “untapped” forest that can provide the most amount of “environmental services.” A green space race to designate space itself as a protected zone. Eco-utilities and forest bonds are some of the instruments that are boosting the neoliberal quantification of space embedded in that process and determining how to classify and demarcate it. The main challenge for this form of speculation, however, is how and whether to make offsetting calculations standard and universal. In order to securitize ecology, the definition of the “values” of each single tree are crucial. For that operation, standard measurements to quantify forests properties would be necessary. However, such agreement on a transnational form of currency or valuing units has yet to happen. No governmental body has proven offsetting mechanisms as simultaneously financially efficient and environmentally successful.

Pierre Bourdieu stated that there are three forms of capital—economic, social, and cultural—and that value can be translated from one category to the other by means of economic conversions.19 Ernst Friedrich Schumacher further articulated this morphology when, after the 1973 oil crisis and the accessibility of fossil fuels was under threat for Western powers, he posited the idea of natural capital.20 Further still, Paul Hawken, Amory Lovins, and Hunter Lovins expanded the lexicon into the notion of natural capitalism at the end of the twentieth century, framing natural capitalism within the notion of eco-efficiency—how to make sense of nature by making money—and arguing that environmental sensitivity is so necessary to shareholders that for the sake of business, corporations should be careful not to miss out.21 Natural capitalism did not refer to capitalism as being a natural phenomenon to humanity, as it was misunderstood at the time, but as something embedded in the trading of nature. This vision implies that the environment has its own assets waiting for human stewards to make the most of them.

It is remarkable how the NYC Street Tree Map promotes people to join as part of the stewardship scheme for “tree care activities.” Under the values of stewardship, the environment is seen as a socially significant space providing resources and/or services in and of itself.22 Hence, the rise of stewardship principles reflects the spatiality of a neoliberal economy, legitimizing environmental protection in order to regulate the extraction of value.23 This process of raising awareness about the value of trees for the city is equivalent to the so-called “Cousteauization” of the oceans: a popular movement to cultivate public interest in the ocean’s biota, through figures like Captain Jacques Cousteau, in order to generate financial support for further marine research and governmental and/or corporate stewardship of marine resources.24 In that regard, neoliberal environmental conservation can extract even more value by “protecting” nature in order to further boost the speculation on its exploitation, be it real estate potential or prospective natural resources. This perverse logic profiteering from environmental protection is what Bram Büscher and Robert Fletcher frame as “accumulation by conservation.”25

Energy efficient glazing or LEED certificates will not make humanity resilient to the effects of climate change. On the contrary, they will carry on instrumentalizing “resilience” in order to create new markets. New forms of capital are monetizing the environment through the banking of nature. Increasingly after the collapse of the housing market in 2007–2008, an ever-increasing number of international investors and credit institutions shifted their activity from real estate speculation to trading natural capital. What we are observing in New York is just one example of a booming market in which inhabitants of the city are environmentally dispossessed by a price tag on its trees. In this transformation process, a neighborhood like East New York, comprised of a population of which more than 50% live under the poverty line, is now becoming one of the highest valued areas of urban trees in the whole city, generating annual benefits of millions of dollars in environmental services for offsetting powers. Very quickly some of the most vulnerable people in the city could be also offset, swept away under a new speculative market where the environment serves as a driving force for new forms of dispossession, real estate speculation, and green “renewal.” The offsetted (humans and other-than-humans) are a new social class that stands not to be displaced, but replaced by trees. Trees might be purifying the air on-site, but the financial value of each tree does not stay in front of citizens’ houses. The double agenda of calculating the carbon footprint for each tree, and the services it provides, exposes how every tree of New York is connected to a very specific architectural site of destruction. It is the responsibility of architects and realtors to de-quantify the “value” of trees instead of profiteering from them and what they offset.

➝.

It has been estimated at $9 per hour. See “NYC Street Tree Map,” ➝.

David Gissen, Manhattan Atmospheres: Architecture, the Interior Environment, and Urban Crisis (Minneapolis: University of Minnesota Press, 2014), 29.

Gregory A. Barton, Empire Forestry and the Origins of Environmentalism (Cambridge: Cambridge University Press, 2002), 163.

Arun Agrawal, Environmentality: Technologies of Government and the Making of Subjects (Duke University Press, 2005), 1–2.

Hazel Healey, “Facing the Forest Entrepreneurs,” New Internationalist Magazine (May 2013), ➝.

As publicly stated on their website: “NYC Street Tree Map,” ➝.

This figure corresponds to August 9, 2017, as it appears on the website of the NYC DPR. As of April 15, 2017, the same platform published that they had mapped 682,515 trees. Between April and August, the city seems to have lost 1,462 trees from their mapping platform.

According to the NYC Street Tree Map website, it is the only tool approved by the California Climate Action Registry’s Urban Forest Project Reporting Protocol for quantifying CO2 sequestration from tree planting projects, see ➝.

Ibid., Gissen, 67.

The term “other-than-humans” softens the binary humans-nonhumans and avoids reducing otherness to the direct opposite of human. See Sian Sullivan, “(Re)countenancing an Animate Nature,” in Bram Büscher, Wolfram Dressler and Robert Fletcher, Nature™ Inc.: Environmental Conservation in the Neoliberal Age (Tucson: University of Arizona Press, 2014), 230.

Ingmar Lippert, “Corporate Carbon Footprinting as Techno-Political Practice,” in The Carbon Fix: Forest Carbon, Social Justice, and Environmental Governance, ed. Stephanie Paladino and Shirley J. Fiske (New York and London: Routledge, 2017), 120.

María Gutiérrez, “Forest Carbon Sinks Prior to REDD: A Brief History of Their Role in the Clean Development Mechanism,” in Ibid., 62.

David Takacs, The Idea of Biodiversity: Philosophies of Paradise (Baltimore: Johns Hopkins University Press, 1996), 5.

Ibid, 27, 107.

“History of Carbon Offsetting and Carbon Trading,” EBSCOHost, ➝.

Chris Lang, “How a Forestry Offset Project in Guatemala Allowed Emissions in the US to Increase,” REDD Monitor (October 9, 2009), ➝.

Ezra Rosser, “Offsetting and the Consumption of Social Responsibility,” Washington University Law Review 89 (2011): 28–29.

Pierre Bourdieu, “The Forms of Capital,” in Handbook of Theory and Research for the Sociology of Education, ed. John G. Richardson (New York: Greenwood, 1986), 241–242.

Ernst Friedrich Schumacher, Small is Beautiful: A Study of Economics As If People Mattered (London: Vintage Books, 1993).

Paul Hawken, Amory Lovins, and Hunter Lovins, Natural Capitalism: Creating the Next Industrial Revolution (Boston, London and New York: Little, Brown & Co, 1999), xvii–xviii.

Philip E. Steinberg, The Social Construction of the Ocean (Cambridge: Cambridge University Press, 2001), 176.

The emergence of sustainable resource extraction practices happened in the mid 1990s with “sustainable certifications” such as Forest Stewardship Council (1993) and Marine Stewardship Council (1996) that regulate exploitation of natural resources in a more responsible way. Yet the tools and mechanisms by which it is done have been heavily criticized as their regulators tend to be permissive in order to ensure they will be called back to certify projects and sites by companies they certify.

Ibid., Steinberg, 178; George Leddy, “Televisuals and Environmentalism: The Dark Side of Marine Resource Protection As Global Thinking.” Annual Meeting of the Association of American Geographers (1996).

Bram Büscher and Robert Fletcher, “Accumulation by Conservation,” in New Political Economy (2014): 1–26.

Positions is an independent initiative of e-flux Architecture.

Category

Subject

The Offsetted by Daniel Fernández Pascual and Alon Schwabe was premiered as a lecture performance in New York on Saturday 11 November 2017 as part of Making Room for Action, Performa 17’s day-long symposium on architecture and performance co-organized by Charles Aubin and Carlos Mínguez Carrasco.

Positions is an initiative of e-flux Architecture.

(2014).jpg,1600)

,-2003,-srgb.jpg,1600)